According to Microsoft Advertising Blog, the Financial vertical remains popular, especially during economic recessions. Marked by its division of labor, globalization, as we know it, is faced with unprecedented geopolitical and pandemic risks. One of the ways out of financial insecurities is a credit card, with the rights granted right away and liabilities postponed for another day.

In case people own some significant capital, they tend to protect their money from inflation by depositing it to savings accounts, which grow in popularity, alongside the cashback and credit card bonus programs.

Much like any other goods, money tends to depreciate. In order to protect their savings, people either look for inflation-proof depositaries or buy the goods now and pay later (i.e., BNPL), especially during desperate times. Long story short, the finance niche is especially active during crises. Therefore, driving traffic there should not be a problem, right?

Financial Vertical Basics

Finances is a mixed vertical, marked by its versatility and diversity. It can either be white (loans, credit cards) or gray (cryptocurrencies, microloans). There is no one-size-fits-all approach, and much will depend on sub-niches, offer conditions, as well as current geopolitical and economic situation. Firstly, finances are composed of:

- Credit Cards

- Loans & Mortgages

- Trading Offers & Crypto (Forex, Tether, Dogecoin)

- Refinance

- E-wallets & Payment Services (Qiwi, WebMoney, PayPal)

- Passive Income

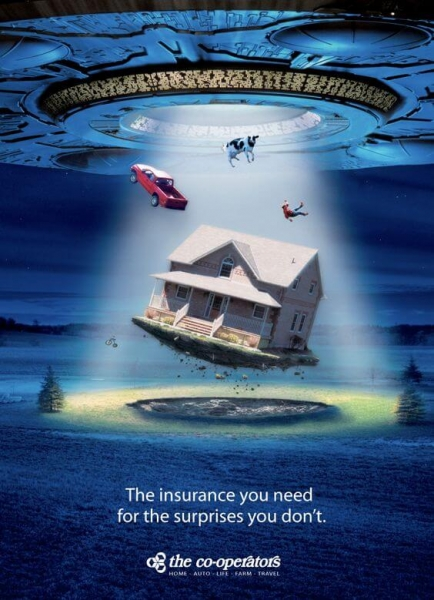

- Financial Insurance

- Financial Aggregators

On the one hand, refinancing, financial insurance, credit cards, and e-wallets should not face any moderation issues. On the other hand, cryptocurrencies are still vaguely regulated, and corresponding campaigns can unwillingly violate the law. In the beginning of October, Kim Kardashian was fined $1.3 million for breaking American law, while promoting EthereumMax crypto on Instagram. Whether the framing was an accident or an essential step in negative campaigning – the advertising got lots of attention.

It used to be impossible to obtain a loan, due to lockdowns worldwide. Therefore, the demand for the vertical is to grow now. The payouts in finance are “backboned” by financial institutes that own the money. Hence, the sums range significantly: from $0.5 to $350 per lead. The variability is justified by the campaign flow, GEO, payout model, and overall complexity. Payday loans with little to no conditions yield humbler profit, compared to full-scale Consumer Loan, where credit approval rate starts to matter. Just be careful of scams, when dealing with MFO and other organizations granting loans left and right. Look for the history of the advertiser, check for his reliability, and browse for some kind of feedback.

To answer the main question of how to drive traffic to finance offers in 2022, let us establish a clear understanding of the failure causes in the first place, by answering a different question.

Why Finance Campaigns Fail?

- Absence of split-testing – do not neglect basic safety measures. Consider split-testing to be your insurance. Yes, you can save a bit by cutting the corners here, but once something goes wrong – you will pay dearly.

- Wrong audience – finances are diverse. Microloan borrowers or gaming nerds might not be interested in the landers like that:

- Trash traffic – financial organizations, especially those dealing with complex register forms and large sums, are obsessed with their reputation and goodwill. Bringing in traffic of poor quality damages that reputation, which is why such accounts will be cut off immediately.

- Small budget – finances take time, effort, and much money to start generating conversions. Your campaign might be flawless, but a lack of proper sponsorship is the way to fall. Your budget is paramount, and payout rates must cover the advertising costs, even if it means picking a traffic source with lower quality in favor of quantity (contextual ads with 50 clicks vs. target ads with 500 clicks).

- Wrong timing – once again, the campaign might be flawless, but poorly timed, e.g., during holiday breaks.

- Lack of flexibility – initial success can make you a hostage of the strategy that grows obsolete very quickly in a highly competitive market of finances. Just because some creatives have been working does not guarantee they will again, due to trends changing, global events reshaping the markets, and stiffer competition.

- Competition – large payout rates beckon every affiliate imaginable. Finances is a highly competitive market, where surprising the client becomes more and more of an impossible mission. The situation is worsened by the fact that banks and financial organizations value their brand identity and will impose strict limitations on your campaign creatives (no brand advertising). To soothe the pain, keep in mind that perfect is the enemy of good (coined by Voltaire):

How to Launch the Campaign?

Start with the offer selection. Traditionally, financial advertisers pay for complicated actions: an ID card entry, loan confirmations, first deposits, etc. Therefore, double opt-in registrations are a norm. The payout usually involves one out of three models:

- RevShare (Forex, Investments, Crypto) – a percent of the advertiser’s income is given to the affiliate and can sometimes last indefinitely.

- Cost-per-Lead (Financial aggregators) – the payout is made for inputting personal data or requesting a loan, with no regard to the actual purchase.

- Cost-per-Sale (Default standard) – the payout is made for a granted loan, first deposit, or bought credit card, i.e., for an actual purchase.

Make sure to check the approval rate of any given bank or another credit organization, the higher – the better. Besides the necessity for the leads to match the campaign criteria, they also have to be approved by the bank for a loan. Finally, what is allowed today may become a no-go overnight, especially in the case of crypto, and get banned on Facebook and other white-hat platforms.

When it comes to GEO selection, financial institutes are widely spread and can include Tier-1, Tier-2, and Tier-3 countries. However, the sub-verticals can be very picky in terms of best-performing countries. For example, trading is better suited for Asia, Africa, and the Middle East. This is due to harsh legislation in the USA for trading, a ban in Algeria, China, and Morocco for crypto, and restrictions in Belgium, India, and Malaysia for Forex. Brazil would fit better the offers for credit cards and Latin America is more interested in loans.

As for the sources of traffic, the following ones rank among the most popular:

- Contextual ads

- Offer walls

- Social networks

- E-mail newsletters

- Search Engine Optimization

- Broker traffic

- Apps for Micro Financial Organizations

- Teaser traffic

Spy tools can help you to establish a foothold in finances, but copying other creatives will not be enough in the long run. The ad format for finances is versatile and can include:

- Pop-under

- Push

- In-page push

- Interstitials

- Banner

- Teasers

Plus, you can try out the ads that promote the philosophy behind the product, instead of the product itself:

Conclusion

Financial vertical grows popular due to a recent COVID-19 setback and geopolitical perturbations. Financial offers house multiple sub-niches and audience profiles: from experienced corporate clients (business loans) to hot-heads, living their lives like there’s no tomorrow (MFO). Consequently, the targeting here is especially diverse.

Here are the seven cardinal sins that can ruin any campaign:

- No prior testing

- Poor targeting

- Cheap traffic

- Inadequate funding

- Incorrect timing

- Unpreparedness for changes

- Weakness before the competition

Monitor what the competitors do to commence your journey in finances, but be ready to set sail on your own, with your innovative creatives. The vertical demands high commitment, but also rewards generously.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!