So, you know how when you’re buying something online, you got to put in your card details at checkout? An e-commerce payment gateway is like the cool behind-the-scenes tech dude that takes those details, scrambles them up real good (it’s actually called ‘encryption‘), and pass them on safely to your bank.

The bank peeps check the info, decide if they’re going to approve that spend or not, and then the gateway passes that message back. If it’s all good, the shop gets the money from your account — like a digital cash register meets security guard.

This gateway dude is like a superhero, protecting your money and your personal info from bad guys and fraudsters on the internet. So, it’s not only a part of online shopping but a key safety feature too.

Importance of secure and efficient payment gateways for e-commerce

Let’s kick off with security. We’re living in the digital age, and not all the folks wandering through cyber-space are good eggs. Some are out to snatch personal information and make a quick buck. But, with a secure payment gateway, you’re fortifying your defense against these fraudsters. These gateways use nifty, high-level encryption to make sure your customer’s card deets are wrapped up safer than a baby in a blanket.

Now, onto efficiency. What do customers hate more than bad guys swiping their card info? — A sluggish, annoying checkout process. Customers want their payment process smooth. By using an efficient payment gateway, you’re zipping your customer through checkout before they can remember that other cool gadget they saw on your competitor’s site. The faster and more reliable the checkout process is, the happier your customers are, and the more likely they are to become loyal shoppers.

Finally, an effective payment gateway lets you accept payments from all over the globe. Whether the customer is chilling with a cup of tea in London or soaking up the sunshine in LA, you’re ready to take their cash. Not to mention, most gateways accept a variety of cards and payment methods, including PayPal, Google Pay, and even crypto these days. That means it’s easier to do business anywhere, anytime, with anyone.

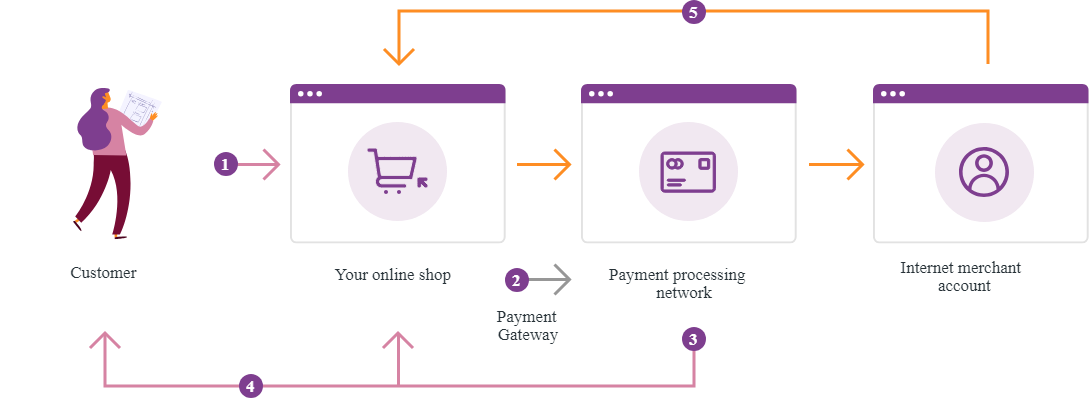

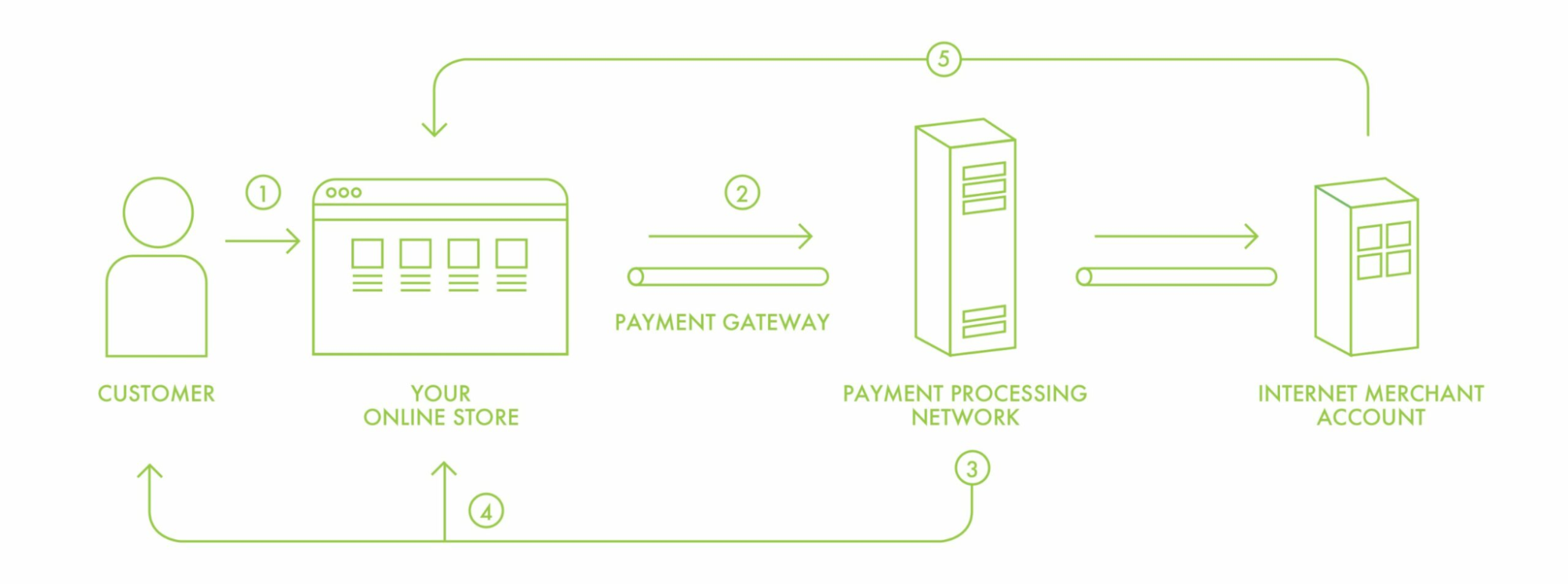

Payment processing flow

When you’re ready to check out your online cart filled with goodies, you put in credit card or bank details, right?

Your details then whoosh off towards the website’s server, who then shouts across to the payment gateway, “Hey, we’ve got a buyer here!”

Now our hero, the gateway, swings into action. It acts as a middleman, passing or rather whispering your payment details to your bank, asking politely, “Got enough cash for this?” If your bank confirms you do, the gateway gives a big green thumbs up to the website server, “Payment is a go!”. If not, a red light blinks instead. You get the update about whether your purchase worked out or not right on your screen, and it all happens quick, due to all the fancy high-speed tech we’ve got nowadays.

Security measures and encryption

Now, doing all this online money stuff has its risks. What if some shady character tries to sneak in and grab your data while it’s on the way? Here’s where security gets real serious.

Payment gateways use what’s called SSL encryption — basically a secret language only your bank and the payment gateway can understand. When your card details are sent off, they’re disguised in this ‘code’, so no one else can make sense of them.

Not to mention, they’ve got to stick by some serious security rules called PCI-DSS. That’s a fancy way of saying they’ve got to make sure your info is super, super safe. They’re required to use top-notch security systems, keep a sharp eye on any weird network stuff happening, and make sure only authorized clicks get access to the data.

Common features of e-commerce payment gateways

Here’s the lowdown on what makes a payment gateway rock:

- Many ways to pay. The best gateways let your customers pay however they want — credit, debit, digital wallets, or even through their bank.

- Handle any currency. Selling to folks across the globe? You’ll need a gateway that can juggle currencies with no hassle.

- Got your back against fraud. The coolest gateways come packed with the best security. This often includes stuff like SSL encryption and needing that special CVV number on the back of the card.

- Regular billings. Selling subscriptions? Some gateways can automatically charge your customers on a regular schedule.

- PCI compliance is a must. All the legit payment gateways meet PCI-DSS standards, so they handle credit card info securely.

- Jives with your platform. The gateway should play nice with your e-commerce platform. Easy integration = better experience for your customers.

- Detailed reports. Where’s the money flowing? Top gateways give you the 411 with thorough reports for all the transactions.

- No time to waste. A solid payment gateway gets payments done in a snap because nobody likes waiting.

- Mobile ready. More folks are shopping right from their phone these days, so your gateway’s gotta roll with mobile too.

Various types of E-commerce payment gateways

Remember, there’s no one-size-fits-all method. You’ve got to pick what works best for you, based on your needs, budget, where your customers are, and how much tech talent you’ve got:

Hosted payment gateways

Just like the name implies, these guys run the show on their own website. You pick something to buy on a site, hit checkout, and then you’re swooshed away to the payment gateway’s site, like PayPal or Stripe, to pay. Once you’re done, they put you back on the original site.

- Good parts: These are super easy to use ’cause they look after all the techie stuff and security. Plus, people often trust them ’cause they’re well-known brand names.

- Not-so-good parts: The big bummer here is you’ve got zero control over the payment experience. Plus, some folks might feel sketchy about suddenly being on a different site.

Pro/self-hosted payment gateways

These keep your customers on your website for the whole buying journey. You collect the payment info, and then you send it to the payment gateway (like Shopify‘s own one) to square away the money stuff.

- Good parts: Makes you look pretty professional, ’cause customers never leave your site while paying.

- Not-so-good parts: All the security stuff is on you! You’ll need a good geek squad to keep this running smoothly.

API/non-hosted payment gateways

These fellas are all about keeping customers on-site too. They use APIs or HTTP queries to link up your checkout section with the payment gateway, dealing with the payment data and all the tech stuff right within your site.

- Good parts: You’ve got total control of the checkout experience, which makes for happy customers.

- Not-so-good parts: You better have some skills to get this running and make sure everything is secure. Again, it’s on you to keep data safe.

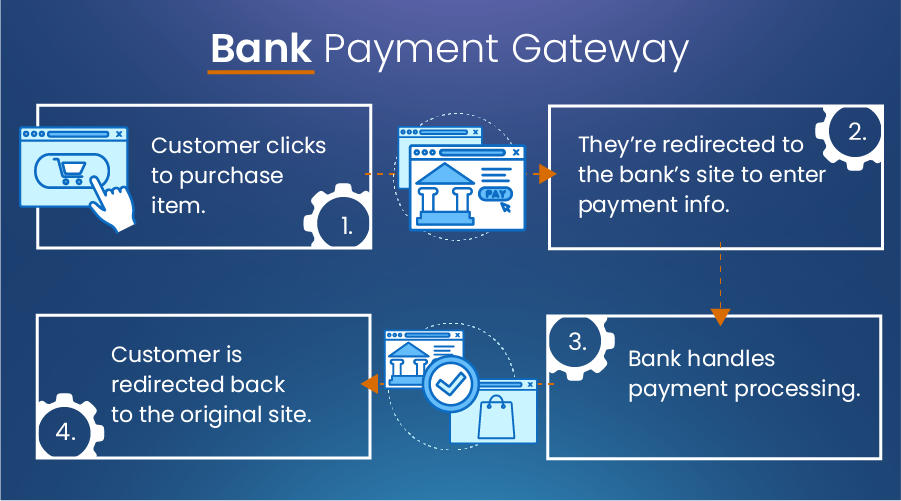

Local bank integration

This one takes your customers to their bank’s website when it’s time to pay. And when the deal’s done, it brings them back to your site. It’s mainly a bank thing.

Good parts: It’s got the trust factor ’cause it’s dealing directly with the bank. Plus, the bank looks after all that tricky security stuff.

Not-so-good parts: The customer experience can be hit or miss, depending on the bank’s site. It can also feel a bit slow with all the site-switching.

Direct payment gateway

These operate totally within your site. From start to finish, your customer stays on your turf. Check out Authorize.Net and SecurePay, for example.

Good parts: Smooth experience for your customers! They won’t bail as often ’cause they can do everything without moving a digital inch.

Not-so-good parts: It’s all on you to keep user data safe and play by the rules set by the Player Card Industry. Get ready for some serious tech work.

5 steps to choose the payment gateway for your business

Choosing a payment portal isn’t something you want to rush into. You’ve got to think about your business needs, what your customers want, whether you can afford the fees, if you can integrate it easily and if it’s safe. Doing your homework can help you decide the right one and nail your e-commerce game:

- Identifying business needs. Figure out what your business is all about. Are you mainly dealing with folks from your own country, or are you shipping across borders, too? Are you planning to charge people once, or do you have a subscription thing going on? You might also want to think if you need fancy stuff like analytics or systems to tackle fraudulent transactions.

- Considering customers’ preferences and habits. Try to picture your usual shopper. What’s their go-to payment method? Do they mind popping over to another site just to pay, or do they love everything happening in one place? Keep in mind, a hassle-free, smooth payment process can do wonders for your business.

- Taking into account the fees and charges. Count up how much the gateway’s going to cost you — we’re talking transaction fees, monthly charges, setup costs, and even sneaky hidden ones. Some portals have a fixed fee for every transaction, while others take a percentage. You have to figure out what this means for your budget, especially if you’re selling cheaper items where fees could bite a chunk off your profits.

- Considering the integration effort. Your ideal payment gateway should slot nicely into your current setup, without turning your online store into a construction site or confusing the heck out of your customers. The easier, the better. You might need a tech whizz to handle the techie stuff, though, so consider whether you’ve got someone on your team who’s up for the challenge.

- Evaluating the security and customer support system. Make sure your portal option ticks all the right boxes when it comes to safe practices, like the Payment Card Industry Data Security Standard (PCI DSS), plus strong encryption to protect data. And check out how their customer service shapes up. Can you get to them fast if something goes wrong? Do they have someone on call 24/7?

Conclusion

Picking the right payment gateway is pretty big. It’s like the heart of your e-commerce site, linking your customers, your business, and the banks, making it super simple to do safe and quick transactions. The perfect gateway boosts the checkout experience and fattens your profit line-up. Remember, it ain’t just about choosing the fanciest tech — think costs, convenience for your customers, and what really makes sense for your business model. Take your time and make it count, because this decision can seriously make or break your online business.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!