Buy-now-pay-later (BNPL) is rapidly gaining popularity and crawling into all the verticals. For instance, aside from the obvious e-commerce and nutra, customers will soon be able to pay for subscriptions and online services in installments.

BNPL in a nutshell

Buy Now Pay Later (or BNPL) is an old concept that has become almost viral over the past year. The main idea is that customers can get what they want right away and pay in installments or pay the whole sum in a few months. Usually, BNPL is interest-free, and you don’t need to pass a credit history check usual for other loans — these are the greatest attractions of this model.

In 2021 BNPL swept e-commerce and nutra off their feet and is gradually taking its place among the most popular ways of payment.

- there may be a 20–25% downpayment

- low to no interest

- 2–4 installments

- minimum «soft» credit checks

- usually no late fees

How BNPL works

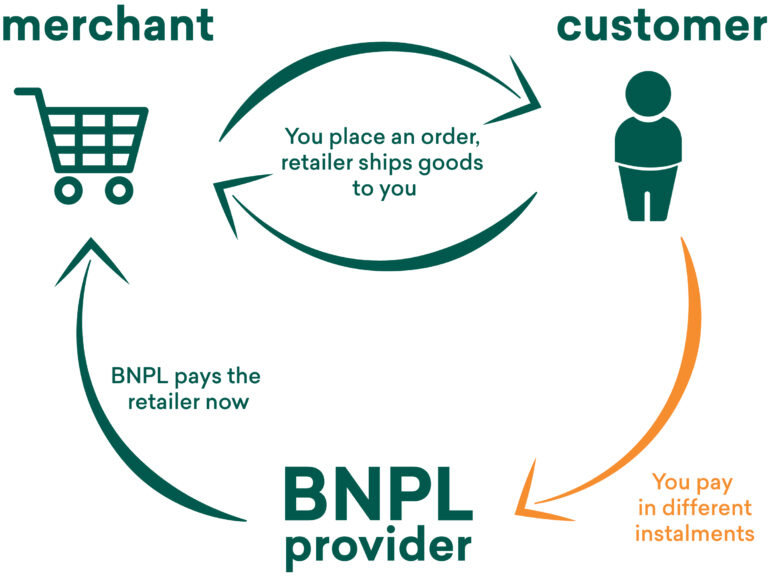

There are three players in this game: a seller, a customer, and a financial entity that provides the short-term loan.

- The merchant strikes a deal for short-term loans with the financial entity.

- The customer decides to buy some item on the merchant’s store, adds it to their cart and initiates check-out with a BNPL as a payment method.

- The financial entity takes a look at the customer to assess their credit capabilities. It’s a fast soft check and does not depend on the credit history or impact it in any way.

- If the customer is eligible, they may be asked to provide a small downpayment or simply get the item «for free» with an obligation to pay the full amount later or pay it back in installments (usually in 4 parts).

- At the same time, the merchant gets the full sum for the goods from the financial entity.

How BNPL may affect affiliate marketing

To better understand the prospects of BNPL for the affiliate marketing industry, we have consulted e-commerce and nutra experts. Here’s what they have to say on the matter.

BNPL is the future of the whole e-commerce industry, not just in relation to affiliate marketing. For instance, in America it is already widely and successfully employed. For the CIS region BNPL is a fresh trend, but there are already providers that offer such financial services, like Dolyame by Tinkoff bank.

BNPL’s advantage is that it makes the client’s LTV higher because he can buy what he wants here and now, even if it’s expensive. And it is possible to cover the younger segments of the audience, young people usually don’t trust banks, do not want to deal with traditional loans and all the paperwork.

BNPL — is a kind of recurring payment that we already use for subscriptions in our info-offers. In Affstar, we see fresh trends and integrate new ideas. We think it is possible that BNPL will also cover premium nutra and e-commerce products in the future. Why not?

Marina Chernova, CEO AFFSTAR

The lean towards BNPL is logical for GEOs where people are used to living in debt, like the USA, for instance. You can buy almost anything on credit, everything is insured. It provides a certain degree of freedom, but this will be unthinkable for some other countries, like Russia and the CIS.

As per offers, e-commerce has a portion of COD offers for wow-products which are usually pricey. If you offer a «pay later» option for those, you will be offering them to people who wouldn’t normally afford these things. And this is moving the market towards microloans. This typically brings about governmental crackdowns and tougher market regulations that make life harder for affiliate marketers.

But if we take e-commerce is general, BNPL is a great seasonal tool for the sales periods like the Black Friday-Cyber Monday-Christmas spree when the shoppers are unstoppable. But it is crucial for all concerned to study the terms of the loan very carefully: the limitations on products, late fees, and non-payment penalties.

Ella Mak, Head of Affiliate Management Department, AdCombo

Key takeaways

- BNPL for customers is gradually expanding its GEO coverage, Asia is now joining the US and Europe.

- This mostly B2C model is now winning its way into the B2B sector as well, with Google and Microsoft conducting trials and acknowledging the soaring popularity of this payment method.

- More and more companies are jumping on this bandwagon including Klarna, PayPal, Mastercard, and Apple.

- Done properly, BNPL is an all-around win situation for sellers, shoppers, and financial intermediaries who cover the «pay later» part of the deal.

- The idea of getting the item/service now and paying for it later is a powerful CR booster, the marketers report average CR surges of 20–30%.

Well, it seems that BNPL is definitely here to stay. If you as an affiliate work with e-commerce or nutra — this is a new direction for your growth, as this kind of financing will help you expand the audience coverage. If your verticals differ from the traditional «physical goods-oriented» ones or you work with GEOs that do not approve of short-term loans — it is still worth discovering the inner workings of this trend. Because «buy now, pay later» is not your usual loan per se, and it is successfully conquering more industries and countries than we could have imagined.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!