In affiliate marketing, everything revolves around money, whether it’s paying for advertising or withdrawing profits. There are many forms of payment available today, but the basic process is the same. Money is moved from the sender’s to the receiver’s possession either through electronic or physical means. Today we will talk about various payment solutions used by affiliates around the world.

Wire transfers

Wire transfers are known for being convenient, but it’s important to remember that these may also carry hefty fees depending on the country or financial institution in question. Different types of wire transfers include bank transactions, debit card deposits, and withdrawals of physical money at cash offices.

While most wire transfers are bank-to-bank transactions, affiliate networks and other entities can also send these payments directly to affiliates without involving a conventional financial institution. That said, these transactions usually have higher fees than others on this list, so you should try to avoid this payment method unless it’s completely necessary.

In addition to the above, wire transfers are safe, relatively fast, and accepted in most parts of the world. This payment method is ideal for affiliates based in the US, EU, UK, and any other regions that have slightly more advanced banking systems as these tend to have lower commissions and shorter turnaround.

Pros

- A most popular and common type of affiliate payment solution

- Extremely convenient

- Compatible with most banks in most countries

- Deposits completed in 24 to 48 hours

- Local wire transfers tend to be more affordable and take less time

Cons

- May have excessively high fees depending on your location

- Wire payments may be subjected to poor exchange rates

- Requires you to provide detailed information

- If receiving international transfers, your local bank may delay the process

Paxum

Paxum is a financial solution designed by webmasters to fulfill massive gaps in the affiliate industry’s payment structure. Paxum’s ATM withdrawal fees are only $2, which are among the lowest in the industry. Because Paxum was created by web developers, the features available in the platform make it an ideal choice for affiliates who run their own websites or apps. It’s perfect for marketers that want to use the same account to receive funds, make withdrawals, and submit payments through POS or online at no cost.

With the above in mind, Paxum does charge users for access to the prepaid Mastercard. And, you also have to pay a relatively high fee for wire transfers through this affiliate payment solution, so it may not be a great alternative for up-and-coming marketers.

Pros

- Extremely popular affiliate payments solution that’s suitable with dozens of platforms

- Designed specifically for affiliates, especially those in adult verticals

- Great referral program

- The low-cost, flat-fee pricing scheme

- Free POS transactions

- Prepaid Mastercard available upon request

Cons

- High fee for wire transfers and credit card withdrawals

- The relatively high annual cost for prepaid Mastercard

PayPal

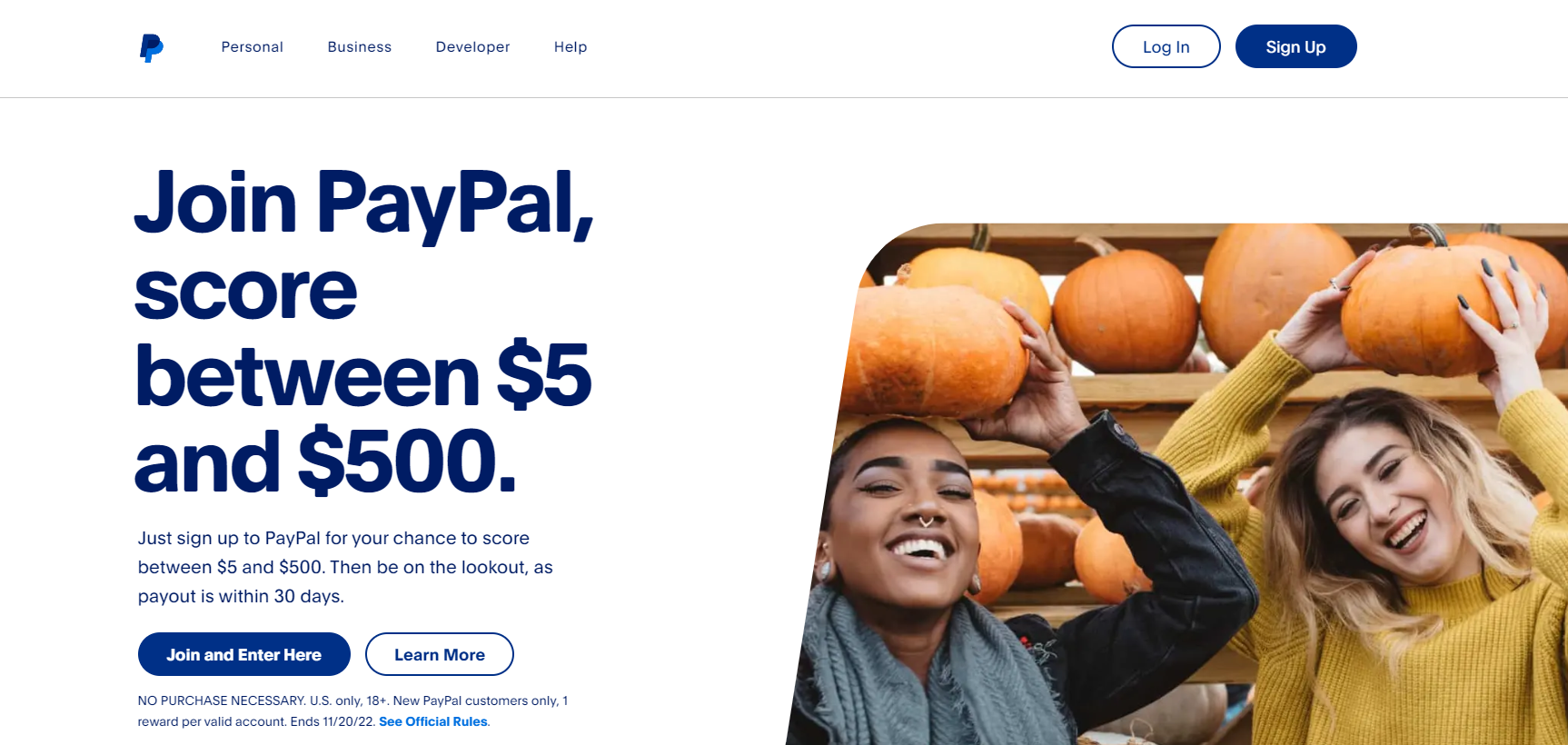

PayPal is perhaps the most well-known payment solution in this list, and for good reason. It’s available in 200+ countries and territories around the world. PayPal is safe, reliable, and flexible in the sense that users can send or receive payments in more than two dozen currencies. That said, PayPal’s fees are relatively high and the bank transfer withdrawal option is available in developed regions and a limited number of middle-income countries.

The team behind PayPal has also developed a series of great benefits for affiliates. For instance, marketers have the option to withdraw money directly to their bank accounts at no additional cost. Or, affiliates can also purchase new traffic and pay their providers directly from their balance.

Pros

- Well-established company with top-notch security features

- Available in 200+ countries and regions

- Allows affiliates to receive funds in 25 different currencies (and counting!)

- Free transfers between PayPal accounts

- Available at all major affiliate networks and accepted by most providers

- Free bank transfer deposits and withdrawals

Cons

- Prepaid card only available in a few countries

- Has strict rules affiliates need to adhere to

- Relatively high commission costs

- Requires a credit/debit card and a bank account

Virtual cards

Virtual cards are convenient for advertising campaigns. It is risky to use a single card to pay for advertising campaigns. It could be blocked by the issuing bank or financial institution when any fraudulent activity is suspected. Consequently, you may experience delays or even fail to make timely payments for online promotions. That is why you need to use virtual cards.

Most virtual card issuing companies charge low fees, and some offer free services. Your payments for ads on Google and Facebook will be effortless and free of unnecessary fees and hidden charges if you use virtual cards.

Best Virtual Cards:

- Capitalist allows you to use its virtual Capitalist Mastercard for reliable payments to several online advertising agencies. But you will need to pay a card issue fee of $3.5, a monthly service fee of $3.5, and an online transaction fee of $0.5. The company has an official bot in Telegram (@CapitalistNet_bot).

- Getsby offers a virtual prepaid card that you can use for Facebook ads and other online advertising campaigns. You can order a Getsby virtual Mastercard card online and receive it via email. The card comes in Green or Black types and supports Apple Pay and Google Pay. You can use it for contactless payments and international transactions at Mastercard exchange rates.

- Wallester is a licensed card issuing company and a Visa Principal Member that enables businesses to buy online media, process payments, and manage corporate spending innovatively. High-reach platforms like Facebook and Google accept virtual Visa cards.

- Soldo provides Mastercard virtual cards for the efficient management of employee spending. Soldo created Google virtual cards for businesses to easily manage their Google Ads expenses. For international payments, it charges 1% above the interbank exchange rate.

- ADVcash is a fully licensed payment system that provides a rich collection of tools for local and international payments in fiat and digital currencies. The virtual cards come in EUR and USD and are available in countries in the European Union, Turkey, and Israel. ADVcash does not charge any maintenance fees for the use of these cards.

Summary

Choosing a payment method is an investment. But, by taking your time and finding the best platform for your goals, you can keep expenses low, increase profitability, and set up a convenient payment system in each campaign.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!