Tastes differ, but some groups of people are more inclined toward certain stuff. According to the generational theory, post World War II generation, a.k.a. Baby Boomers (1946–1964), are hard-working individuals, raised in relative poverty: limited resources, limited schooling, limited jobs, and a lot of competition. It should come as no surprise that they are very picky about the products promoted online, especially branded ones.

As a result, we can assume Boomers are resilient to hype and focused on functionality. In other words, if the latest iPhone cannot offer anything special to cater to the Boomers’ needs for a reasonable price — they are most likely to pass. This gives rise to a speculation that certain mobile phone models characterize their owners. If that’s the case, then you can guess who your target customer is by simply looking at their cellphone. And in this article we will (dis)confirm this assumption.

Android vs. iOS customer characteristics

Android and iOS are the most widely spread mobile OS in the world, enjoying the global combined share of 98%. Moreover, the mobile market in general has more users than the PC does. That’s why it is reasonable to focus on this market alone and create a customer persona for each, so that you have an approximate idea of how your desired user looks like.

According to Forbes, American men prefer Androids, buying them more often by 14%. Next time when picking a gender to target, remember that girls love iPhones 😉

No need to think it is only about gender. There are many other interesting characteristics to consider:

- Education: iPhone users are 27% more likely to complete their PhD degree.

- Income: people with the household income (income before taxes of all family members for 12 months) of > $125,000 are 48% more likely to opt for iPhones.

- Specialization: Android people are tech-savvy, overweighting 50% for computer, technical, and medical careers. iPhone people are inclined toward management, communication, and sales (overweight by more than 30%)

- Technology news: both Android and iPhone users tend to read this kind of news, but Android-spirited people overweight by 35% overall, which might be the consequence of them being tech-savvy. Consider targeting Android when entering technological platforms, e.g., topical Subreddits.

- Early trend adopters: both Android and iPhone users tend to cut the land-line cord, which is a sign of swift shifting toward innovations.

- Device addiction: both groups are addicts, but iPhone takes the cake — overweighting the other groups by 67%. The iPhone lovers spend more time gazing in the screen, but they are also more likely to turn ad blind — improvise.

- All eggs in one basket: Android users are inclined toward having 3 cars (overweight others by 20%), whereas iPhone fans aim for just one (scoring 11% more than the others). Either they invest all the money into an iPhone or just live in urban areas with few parking places.

- Alcoholics: both groups have relatively few total abstainers, while Android users are inclined toward hard liquor.

- Push notification responsiveness: Android users interact more actively with the pushes (4.6% vs. 3.4%). They are also more likely to subscribe for push notifications, compared to iOS (81% vs. 51%).

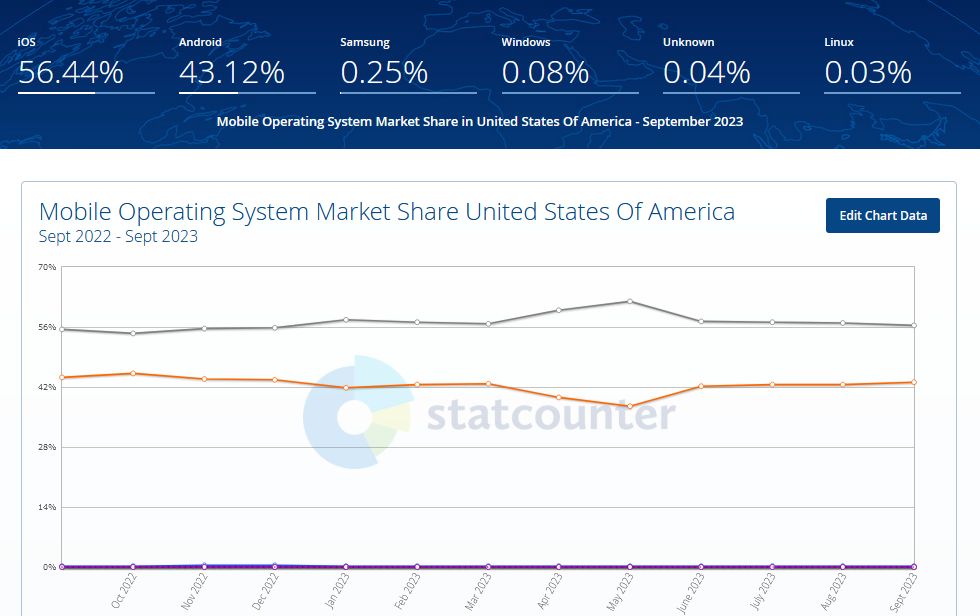

All factors combined, Android users tend to be frugal and free-spirited creators: male, technical, and hard drinkers. Contrary, iPhone lovers are rather consumers with strong addiction for gadgets instead of alcohol. Overall, iPhone users tend to spend more in App Store, compared to Android users and Google Store (86 billion vs. 41 billion). It should also be noted that Androids retain greater market share of 70%, compared to 28% of iOS. But, when it comes to the devices themselves, Apple products enjoy global dominance with the share of almost of 30%.

Also, always consider local specifics, because in the USA, for example, there are more iOS users. So, when targeting the Americans, they are more likely to use the American phones, produced by Apple.

Smartphone dependency

Some people use smartphones exclusively, owning no other gadgets or at least broadband connection whatsoever. Here are a few facts about the USA and exclusive smartphone usage.

- People of 18–29 years are more likely to have just a cellphone

- About 25% of Hispanic adults rely on just cellphones

- Lower income level increases the probability of smartphone dependency (it’s not about addiction, rather about having smartphone as the only access to global web)

- The higher the education — the lower smartphone dependency is

To sum it up, youngsters with relatively low income and education are forced to enjoy just a cellphone. It also happens that they dream of an iPhone, which can be attributed to its social status and low depreciation level (can be sold on the aftermarket). However, with experience and subsequent money, the adults start to own other gadgets too; depending on the occupation, they might be quick to switch to Android devices for their universality, fast updates, and affordability — why paying out more for the same features? But iPhone dominates the USA market for a reason.

Customer Personas of Android vs. iPhone

iPhone is famous for security and seamless experience. It is neat, polished, and pristine — you don’t have to think about anything, everything is already done for you… for a price. Android-based devices, on the other hand, are open-sourced and very customizable. Roughly speaking, it’s like a comparison between a prestigious exotic car (e.g., Mercedes) and a Japanese tuner (e.g., Toyota); or between a pre-made and hand-made PC. The former suits businessmen, beauty bloggers, celebrities — those, who do not want to bother with understanding how things work. The latter complements geeks, enthusiasts, DIY-addicts — those, who are ready to spend time on learning and saving money.

Here is a head-on comparison of two customer personas, based on the info above. This is a rough approximation, but should give you an idea to work with and spur your imagination.

| Alex Android | Emily iPhone |

|

|

Manufacturer-based targeting

It’s no surprise, each brand in every industry holds a certain niche. The same applies to mobile phones. Whether it’s the aforementioned Apple or Samsung, each company has a certain segment in mind. Let’s think about who is usually targeted by the most popular mobile device manufacturers.

Apple: Outlaws (archetype), Balancers, Peacocks. Outlaws are all about being unique, thinking differently, and being not like everybody else (thinking like 95% of the population). Balancers (32–5 y.o.) always feel inner guilt as they try to excel at everything without having enough time — when they are at work, family pops up in the mind; when staying at home, they feel like procrastinating etc. Peacocks (18–30 y.o.) are attention-seekers with external locus of control.

Samsung: Creators (archetype), Conscious progressives, Actualizers. Creators give form to a vision, look for a long-lasting value, and appreciate self-expression. Conscious progressives (18–30 y.o.) appreciate deep, even intimate, connections and genuine, real-life communication. They value personal growth, travelling, and knowledge. Actualizers (30–55 y.o.) are highly practical, cost-saving, determined, family caring — determined businessmen in a nutshell.

Huawei: Magician (archetype), Carpe Diems, Sharers. Magicians believe in fairy tales and make them come true. They look for self-improvement, transformation, change — always in motion, but with little-to-no pain. Carpe Diems (18–30 y.o.) — daredevils, who love to go out, be into the latest technological trends, and stay independent. They can frequent gym, poker clubs, car shows etc. Sharers (30–55 y.o.) are all about spreading love and harmony. Lower standards of living intertwine peculiarly with industrious character, willingness to do house chores, and readiness to attend gym.

Conclusion

Basically, the choice between the mobile OS boils down to personal values. If the customer wishes for stellar customer service and user experience, where everything works like clockwork and fits like a glove — then iPhone is a better option. On the other hand, if the customer wants something truly unique with a touch of personal character, then Android devices are at their disposal.

When it comes to specific manufacturers, Apple is all about trailblazing, standing out, and being not like everybody else (despite its products being in the highest demand). It’s funny, considering the whole iOS ecosystem enjoys less customizability, compared to Android-powered devices. Samsung targets pragmatics — a very loyal segment, when served right. Huawei helps the dreamers to make their wishes come true (or creates an illusion of doing so).

If you are interested in more manufacturer-based segmentation and want to create your own understanding — it is a good idea to look at a brand’s commercials. Look for the message conveyed: What’s the emotion? What’s the language? Are there any people? How old are the actors? What’s the landscape? What’s the vista? What’re the colors? Think about your friends who would get hooked by a certain ad and deconstruct his or her persona, habits, and preferences.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!