Like all Internet users, affiliates use bank cards to pay for goods and services. However, it’s not always possible to use a card when purchasing traffic, and not all affiliate networks provide bank transfer as an available method of payment.

The reality is that finances are processed through various payment services as far as affiliate marketing is concerned. We have gathered the most relevant information on five payment services used by affiliates worldwide with a particular focus on commissions, the registration process, and the key pros and cons. Experience shows that it’s important to be familiar with all of the payment services available.

Paxum – a Canadian payment company established in 2010.

Paxum offers two account types: for business clients and for individuals. We’ll touch upon personal accounts that are quite popular among affiliates. When opening a personal account, you’ll also get a debit card for easy access to your funds. An online account can be opened in dollars, euros or pounds.

A Paxum account holder can either have only an e-wallet or get a debit card linked to this wallet. It’s also possible to interlink your PayPal and Paxum accounts. Some networks have entered into a partnership with Paxum and therefore provide better traffic acquisition terms to Paxum account holders.

P2P transfers are not subject to commissions. The company also offers ACH (USD) and SEPA (EUR) accounts for working with USA and EU companies.

To register an account, you are required to submit your passport data. Verification is carried out according to two parameters: identity and address. To pass a verification process, you need to scan or take a photo of your passport.

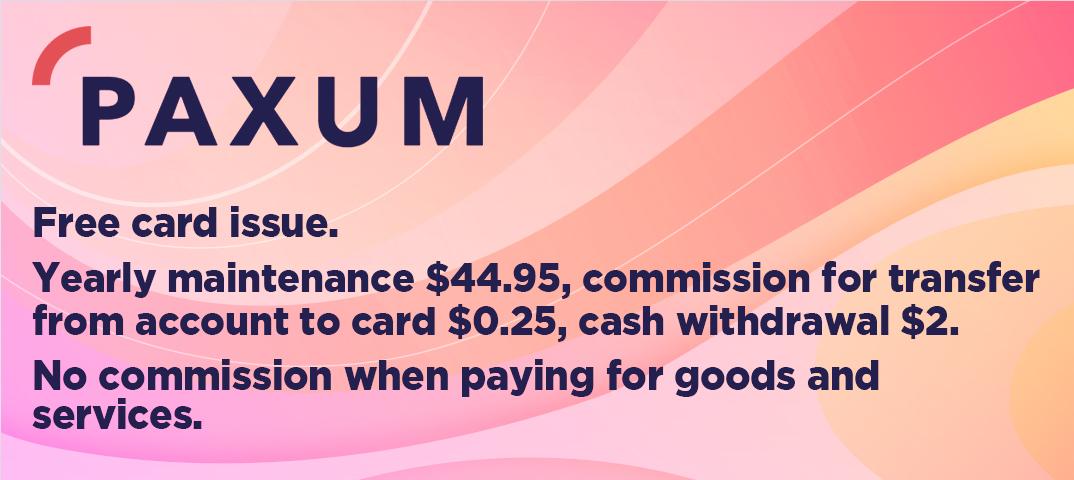

The issue of a Paxum prepaid card is free of charge. The yearly maintenance fee amounts to $44.95, the commission for funds transfer from an account to a card – $0.25, cash withdrawal – $2, and no commission is charged when purchasing goods and services. You can find all the information on other fees on Paxum’s official website.

ePayments is a British payment system with Russian roots. The company was founded in 2011 and was initially aimed at people working remotely and receiving payments from all over the world.

Like Paxum, ePayments offers both virtual accounts and plastic cards. Virtual accounts can be opened in dollars, euros, and rubles, while plastic cards are issued either in dollars or in euros.

Transfers to other ePayments clients are free of charge. You can receive payments through direct bank transfers and top-up your cards with 7 major cryptocurrencies.

There is one drawback: as of today (May 2019), Russian citizens cannot order a plastic card. However, this option is available for EU citizens.

To open an ePayments account, you should register at their website and verify your identity and address. It takes about 4 days on average and requires passport data.

Instant transfer from an e-wallet to a card is free of charge, while the commission for instant transfers to WebMoney constitutes 2%, which may deter some users. Monthly maintenance accounts for $2.9. However, if you spend more than 300 dollars or euros per month, next month’s maintenance will be free. The card issue amounts to $5.95. Other data on tariffs and commissions can be found on the ePayments official website.

WebMoney – a Russian payment system established in 1998. The company is very popular in the CIS countries and among many Russian services ranging from Internet stores to affiliate programs. There are lots of WebMoney exchange offices, which means that you can exchange currency instantly and without much effort. It’s also possible to transfer money to other payment systems and to partner banks’ cards.

To interact within the platform, you should contact a registrar and verify your passport data, so don’t count on anonymity.

Each internal transaction is subject to a commission of 0.8%. There are certain limitations on fees depending on a wallet and transaction type. WebMoney has lots of exchange offices. Moreover, the additional commission can be charged for a top-up or withdrawal.

PayPal – an international payment system founded in 1998. The company has worked in close cooperation with eBay for a long time and has established itself as one of the best and most reliable payment systems for purchasing and selling goods.

To start carrying out transactions, you should open a personal account and link your card to it. Unlike other payment services, PayPal requires you to verify only your card. To exchange money on favorable terms, we recommend that you opt for currency exchange at a bank rate.

There are certain limits on the total amount of money you can send from your account in a single transaction. To increase your limit, you should pass additional verification. Transfers and top-ups within a platform are charged with a relatively high commission of 3.5%. We recommend that you use this system only for purchasing goods.

Payoneer – a payment system established in 2005 and headquartered in New York. The company is included in the Inc.5000 top-100 of the fastest-growing companies.

Payoneer is a good platform for freelancers or people working with or on freelance marketplaces. The company is constantly signing agreements with major freelance marketplaces where you can find work online.

Payoneer enables you to send payment requests to your clients or employers, whether individuals or businesses, via email, for instance. This option will come in handy for affiliates or teams working with freelancers.

To register in the payment system and get a card, you need to provide your passport data and bank account details. However, you don’t have to use this bank account.

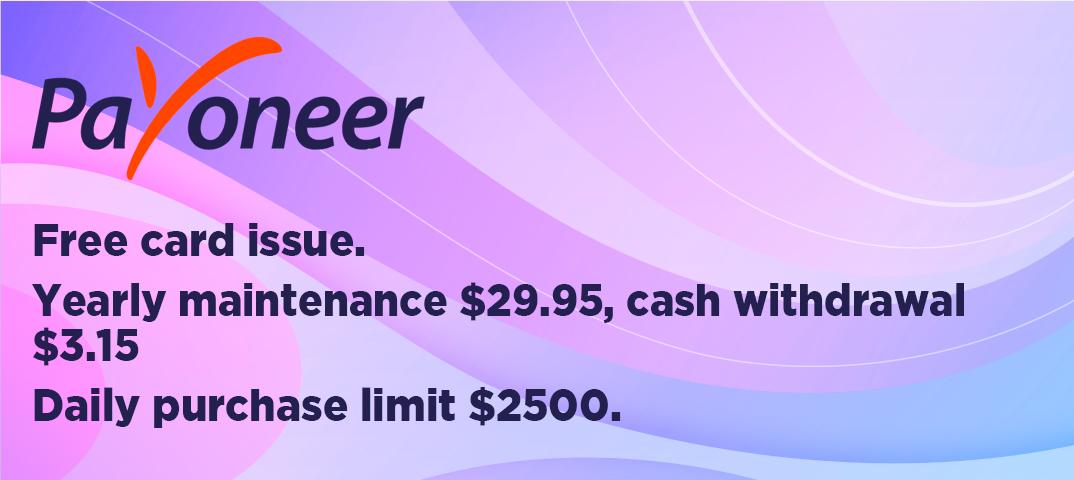

As regards commissions and fees, internal transfers are free of charge. The yearly maintenance fee accounts for $29.95. The commission for funds transfer to your local bank account constitutes 2%. The commission for cash withdrawal through ATM or from a bank is $3.15 for a single operation. The daily purchase limit amounts to $2500.

It’s up to you to decide what payment system to use. However, you shouldn’t forget that it’s advisable to use various tools depending on your goal, and this applies to payment services as well. It’s more cost-effective to purchase traffic from a Russian network using WebMoney, while it’s more convenient to pay a freelancer through Payoneer. In our next article on payment services, we will explain how to use various payment systems to top-up your account in various networks.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!