Vietnam is a GEO with an estimated 95 million inhabitants. Although 95 million people account for 66% of Russia’s population or 5.5. of that of Kazakhstan, microfinance offers in Vietnam don’t receive a lot of traffic. Why so? Are Vietnamese people too reluctant to borrow money or do local payday loan financial institutions have modest appetites? Or maybe the market is only nascent and now is the time to start sending traffic to payday loans in Vietnam? What is the level of competition there?

The CPAlab team has run a market research study to figure out what prospects the niche holds for affiliate marketers:

- Average traffic volumes for finance offers

- Affiliate networks and offers

- Affiliate rates

- EPC and CPC

- Affiliate traffic share

- Search traffic share

- Social traffic share

- Conclusion

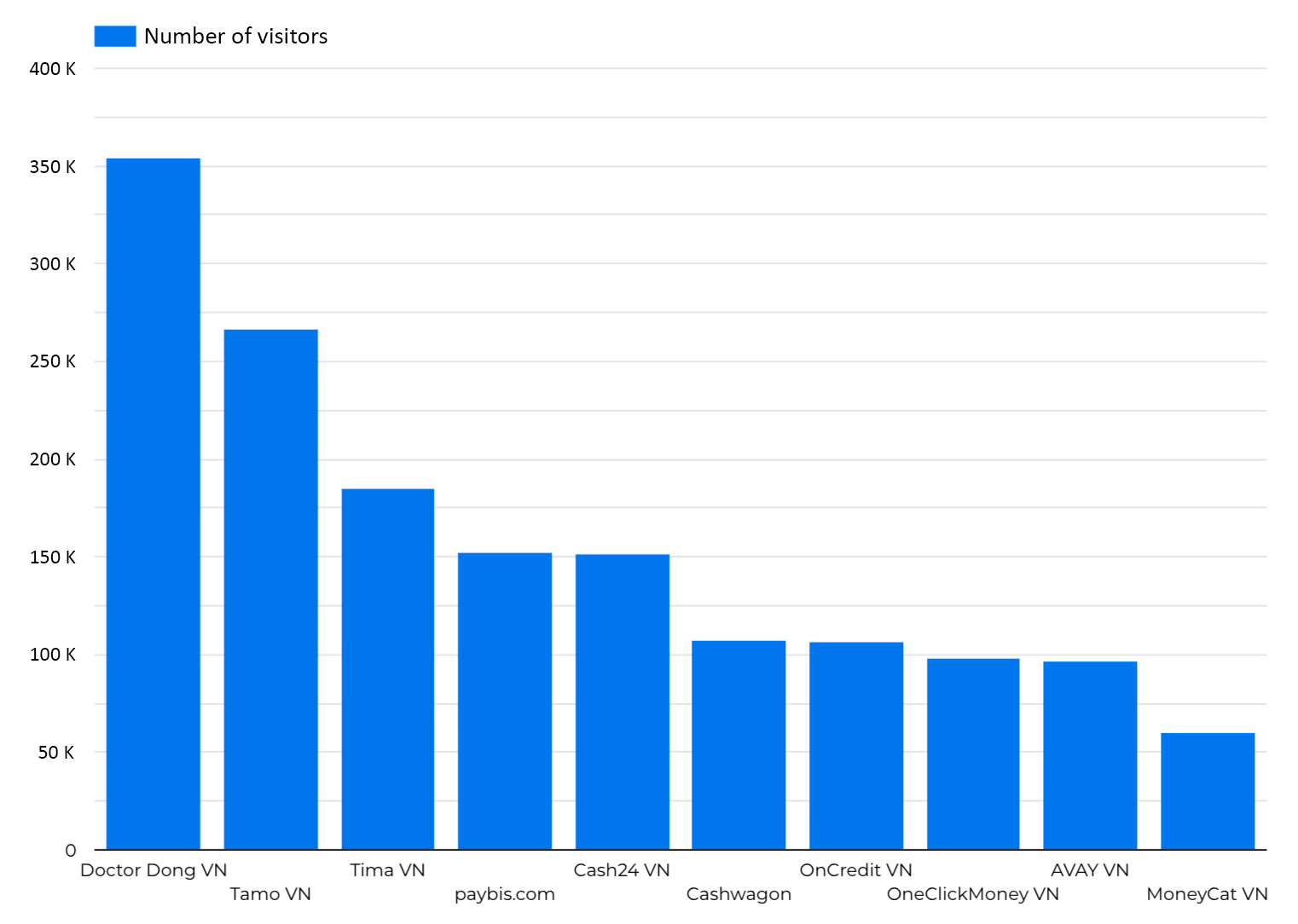

Average traffic volumes for finance offers

TOP-10 payday loan products and services in Vietnam generate from 50,000 to 350,000 monthly visitors, far fewer than their Russian counterparts, at least according to Similarweb.com. The market competition is still quite low.

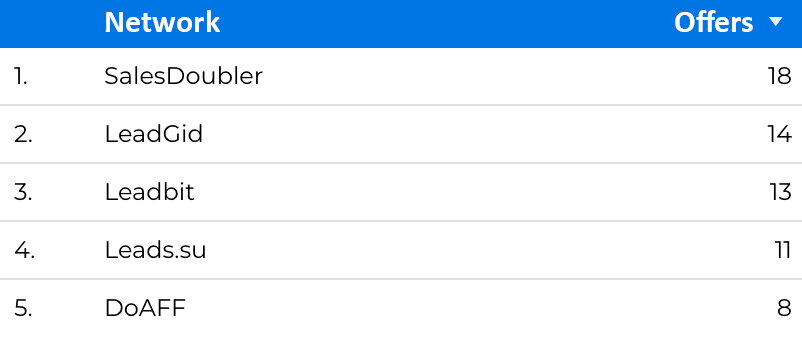

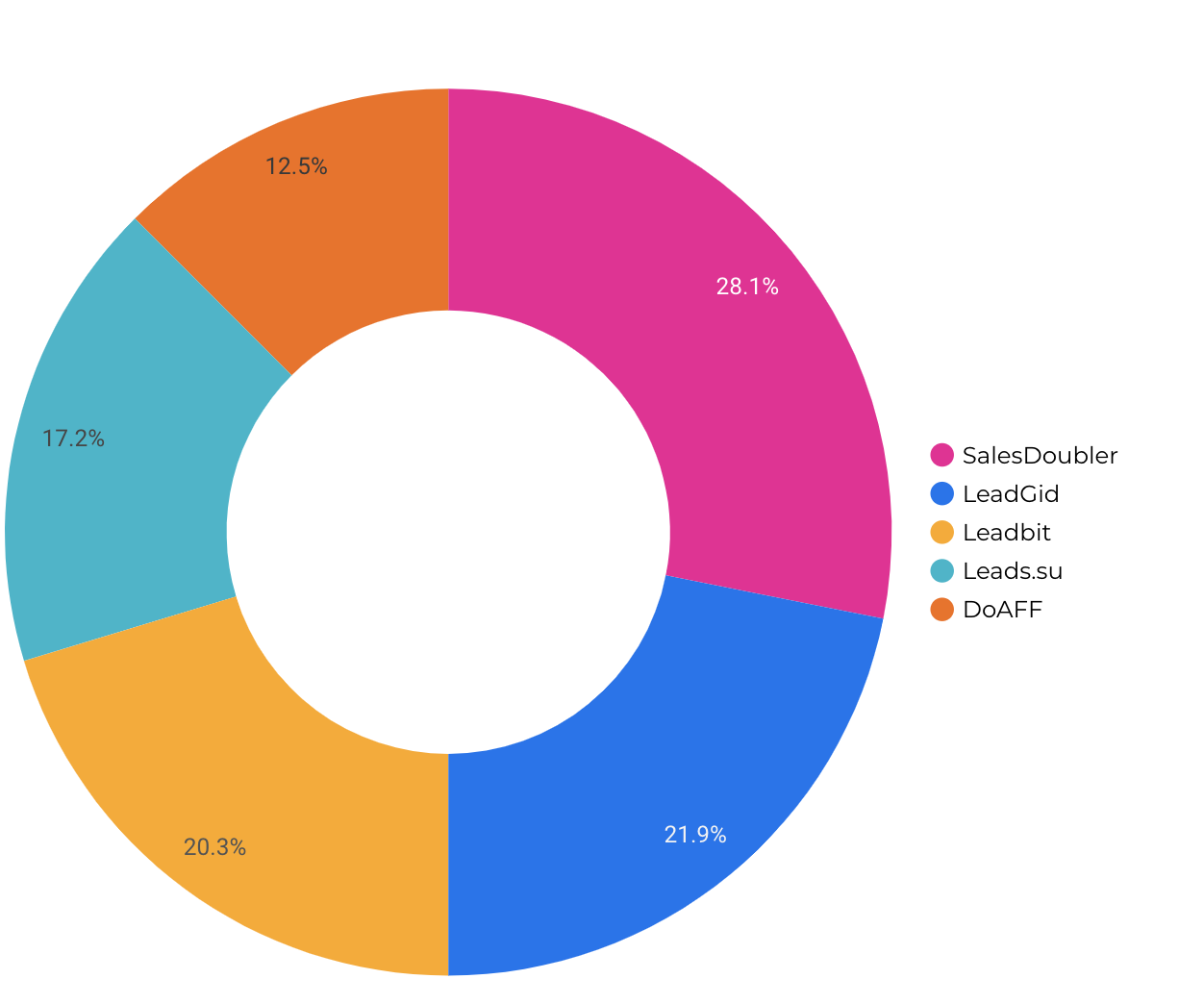

Affiliate networks and offers

Five major affiliate networks operating in Vietnam are originally from the CIS and include the likes of LeadGid, SalesDoubler, Do Affiliate, Leads, and LeadBit. Another market player is the largest Asian affiliate network Accesstrade.global.

SalesDoubler, Leadgid, and Leads.su databases showcase over 10 offers for Vietnam. The three networks account for over 70% of the total market share.

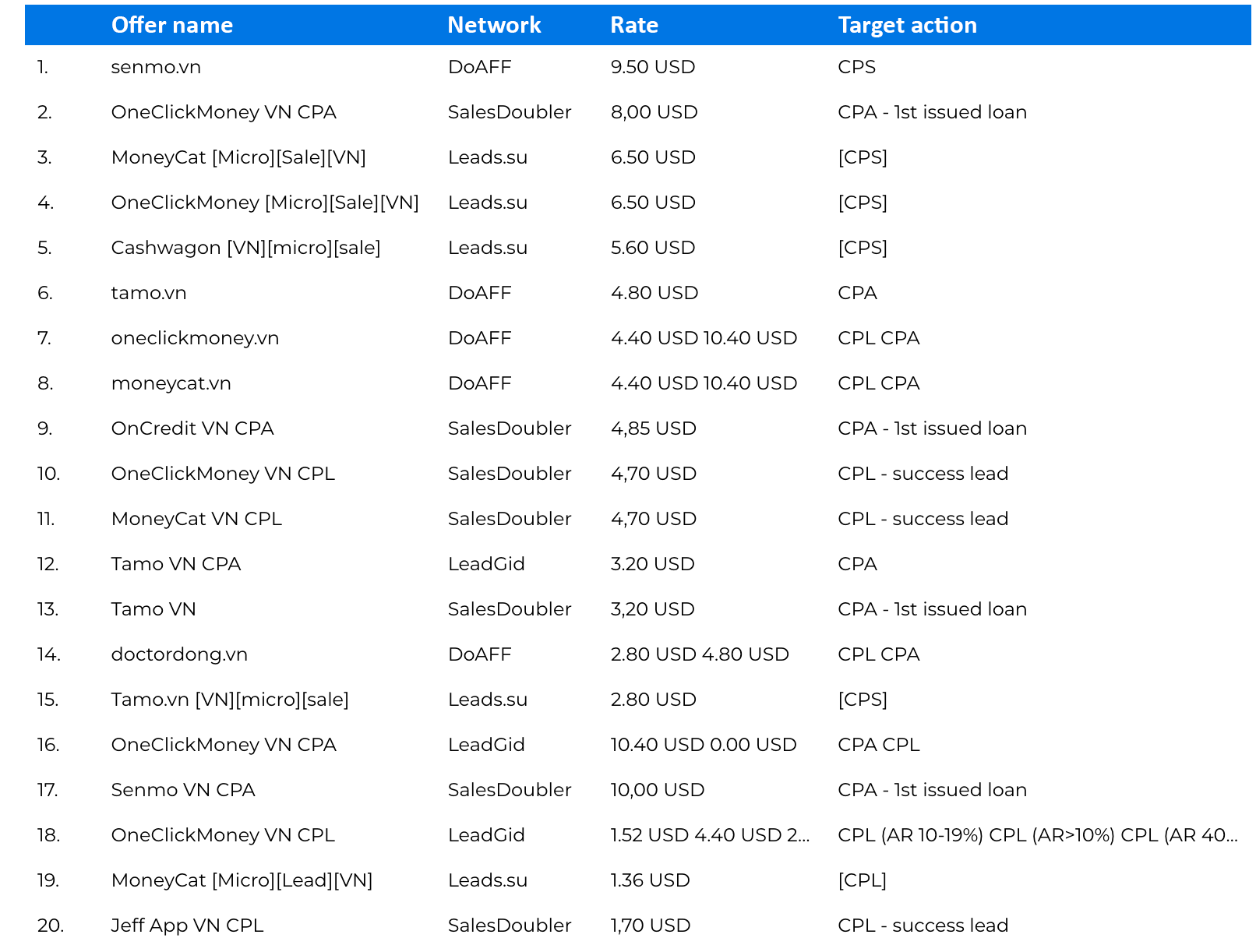

Affiliate rates

Most microfinance businesses work on the cost per sale (CPS) model, i.e. they pay you for every loan taken by a user you referred to. Affiliate payouts vary from $4 to $8. If you run on CPL, your commission will be within the range of $1 to $3.

Affiliate rates also vary across different networks. For instance, Doctor Dong VN Leadgid is willing to pay you $2.24, while Doaffiliate is ready to fork over $5.6 (depending on the payment model and target action). MoneyCat will pay you $5.6 if you work with Leads and $10.4 if you work with LeadGid.

So, consider sending traffic to a couple of networks at once to get better rates.

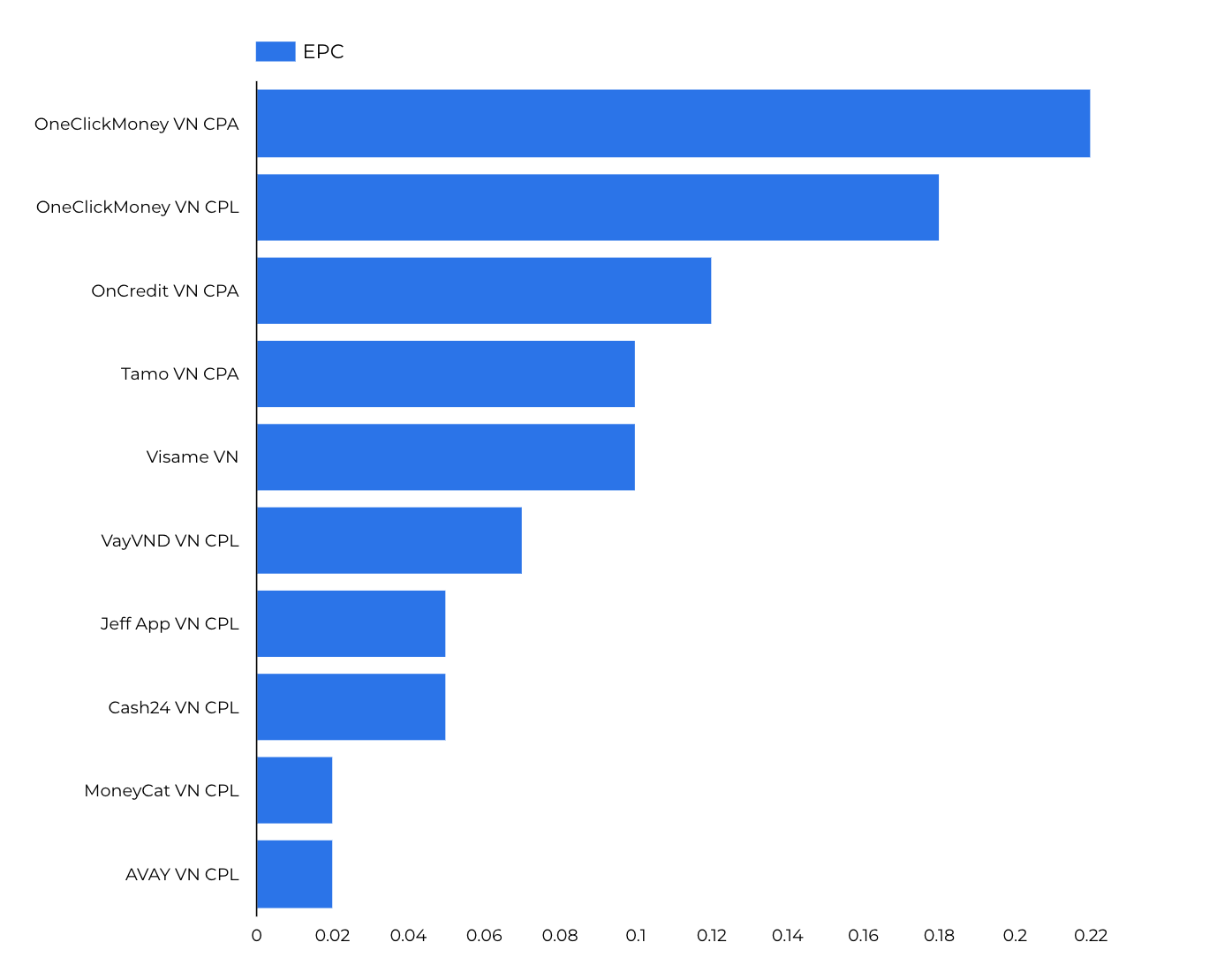

EPC and CPC

The average EPC is about $0.8-$0.14, which is pretty low considering that traffic costs on GoogleAds are $0.8-$0.10. Facebook, being a cheaper traffic source, is a much better choice for this GEO.

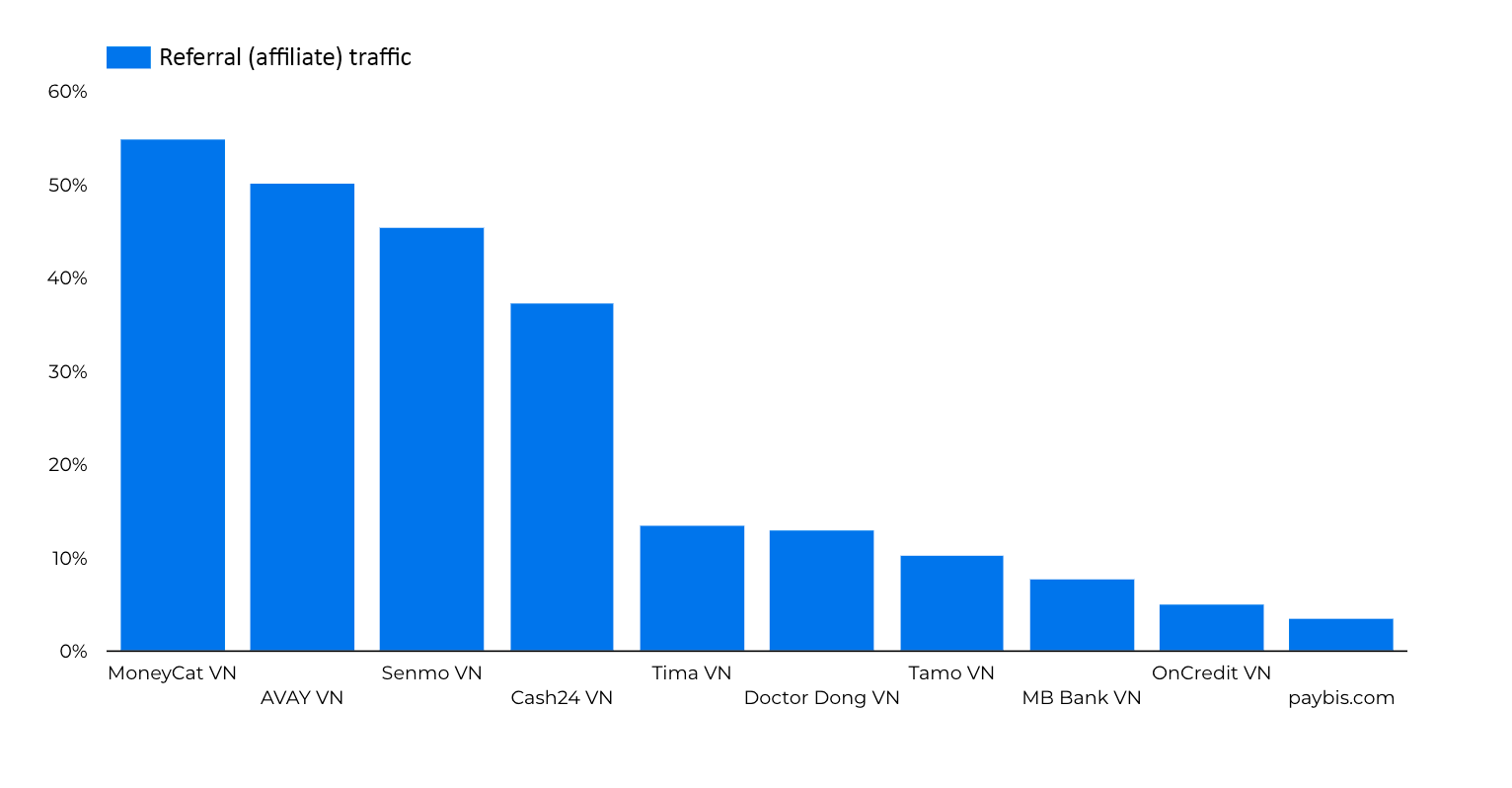

Affiliate traffic share

Affiliate traffic comprises the lion’s share of the overall traffic volume and amounts to about 50-60%, and Vietnam is no different from other countries in this respect.

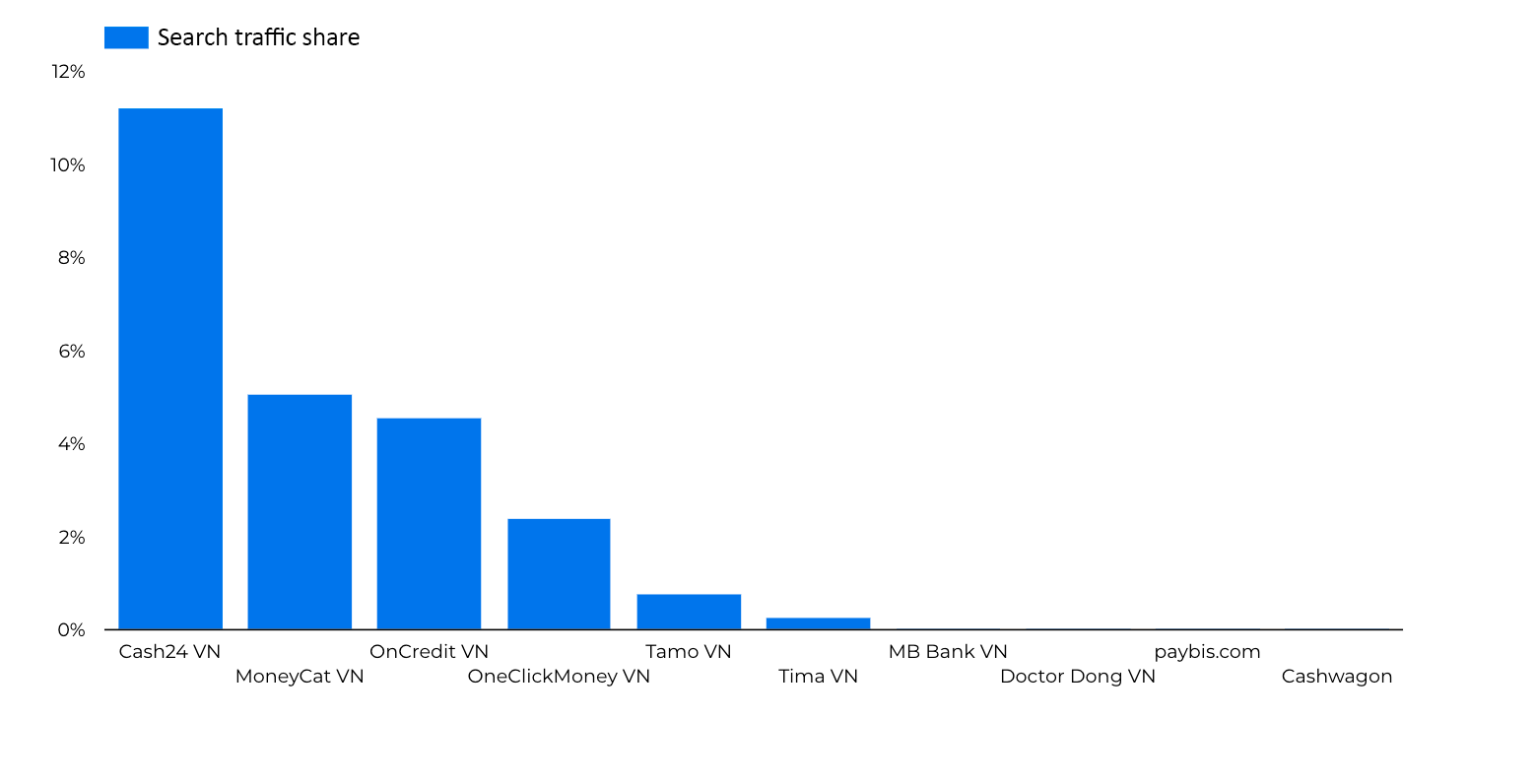

Search traffic share

As a rule, microfinance institutions in Vietnam don’t buy contextual ads on their side, and the share of search traffic accounts for a mere 3-5%.

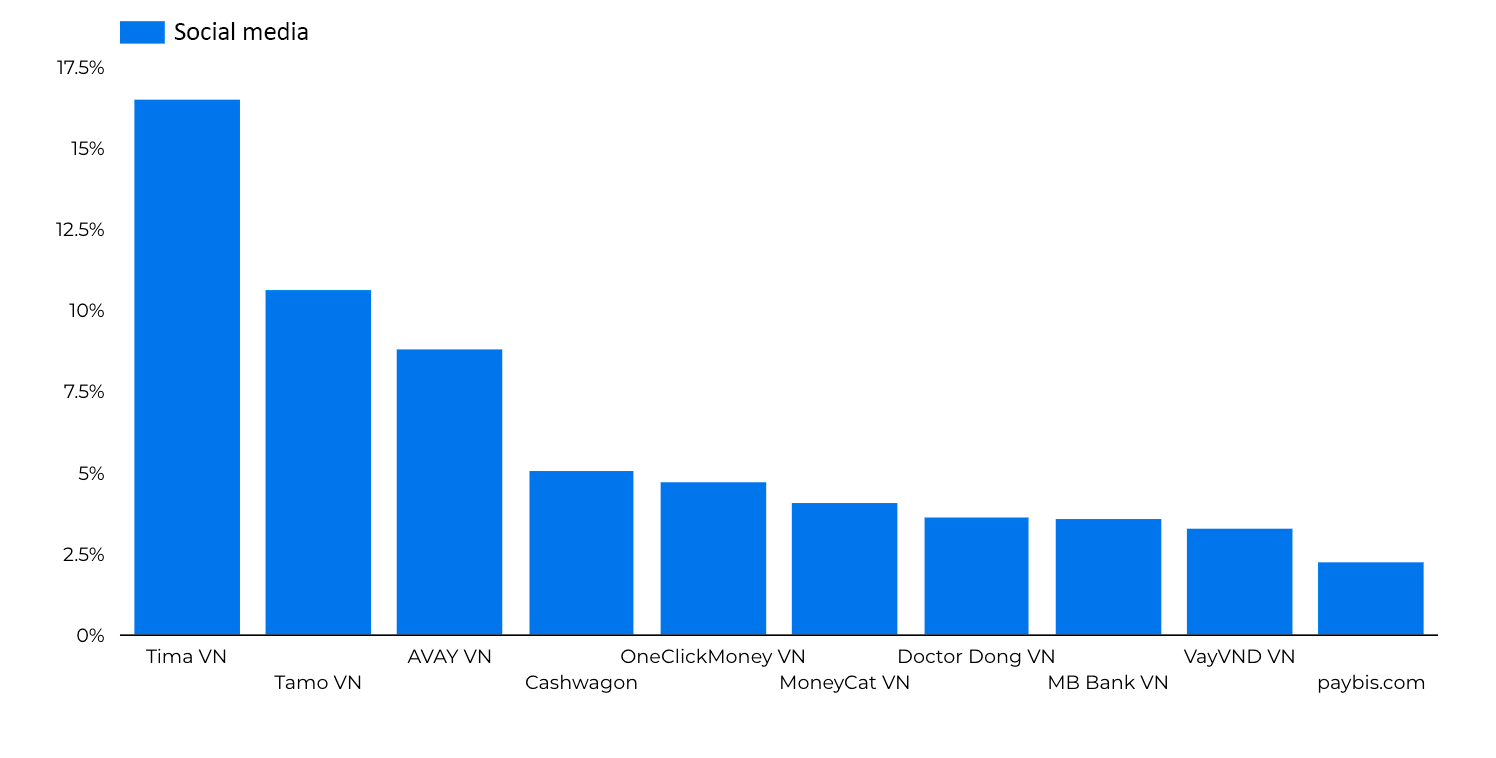

Social traffic share

Social media advertising is more popular with Vietnamese payday loan businesses, and so social traffic makes up about 5-10% of the total share.

Conclusions

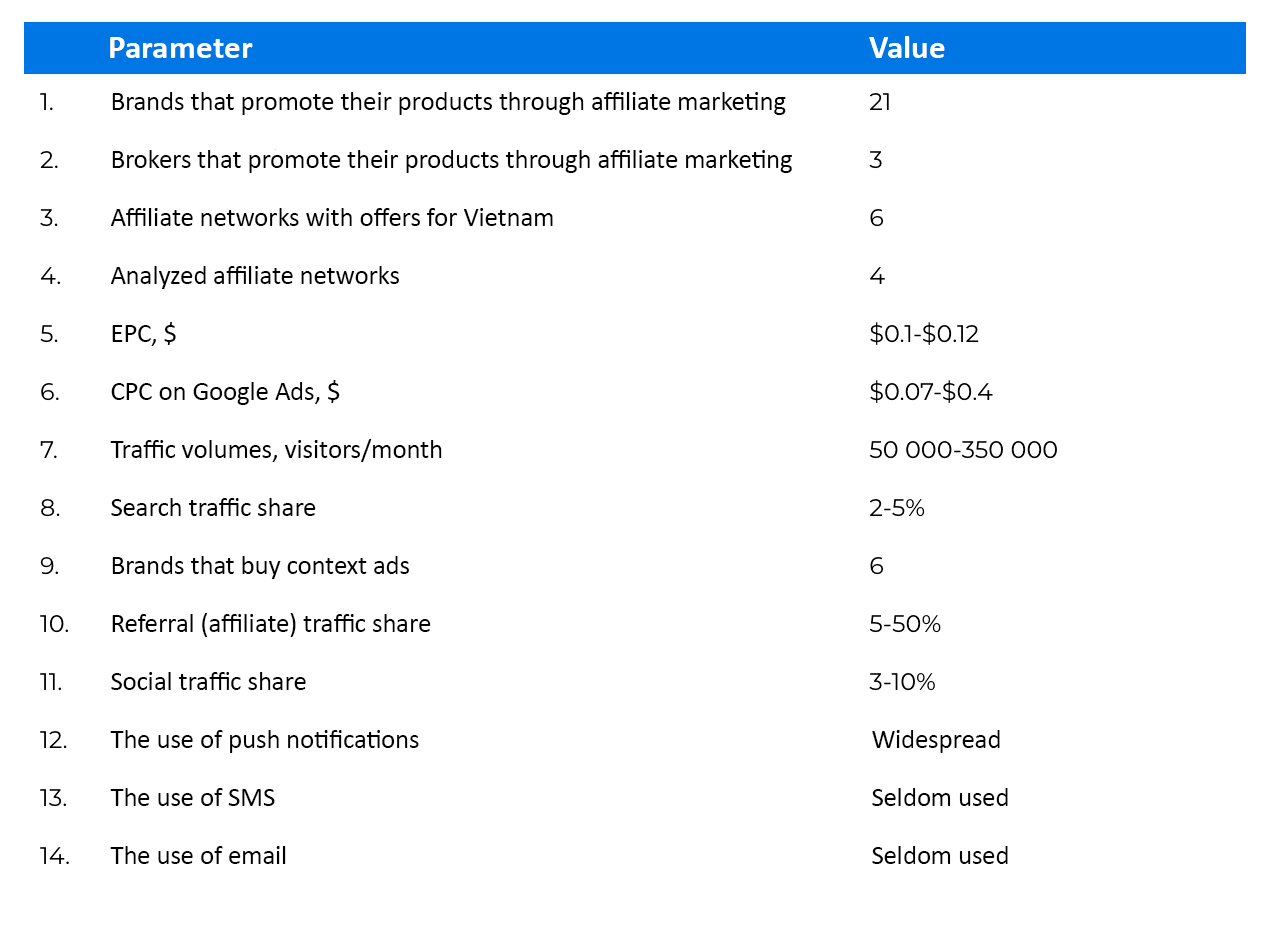

Before arriving at a conclusion, let’s take a closer look at the spreadsheet below:

Pros of running finance offers in Vietnam:

- Low traffic costs allow affiliates to collect statistically sound data and score a winning campaign even on a shoestring budget of $1000.

- Microfinance institutions in Vietnam still buy very low traffic volumes compared to the country’s population. The market is at its nascent stage.

- Not all market players use SMS and email marketing techniques to monetize their database, which means that you have plenty of opportunities to optimize your traffic costs and improve your ROI.

- So far, there are no brokers who would offer paid services and charge money from users’ cards, and therefore you can set your bids higher.

Cons of running finance offers in Vietnam:

- Low EPC indicates that Vietnamese microfinance institutions have modest appetites and are not particularly interested in ramping up their traffic volumes.

- Lack of transparency in market regulation. At any point, the authorities can ban payday loan businesses or crackdown on the microfinance market, and therefore on affiliates.

Anyway, it’s up to you to decide. In our opinion, this market holds a lot of opportunities for affiliate marketers to grow.

The information presented in the charts above is from similarweb.com and affiliate networks that kindly agreed to provide their data.

Author: Andrey Smolyakov, CPAlab.online co-founder.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!