Chances are those of you who run ads for cryptocurrency products and services have been closely following China’s attempts at upending the dominance of Bitcoin.

The country’s central bank-backed digital yuan has triggered huge controversy immediately after its launch and is now expected to go head-to-head with other cryptocurrencies and the US dollar.

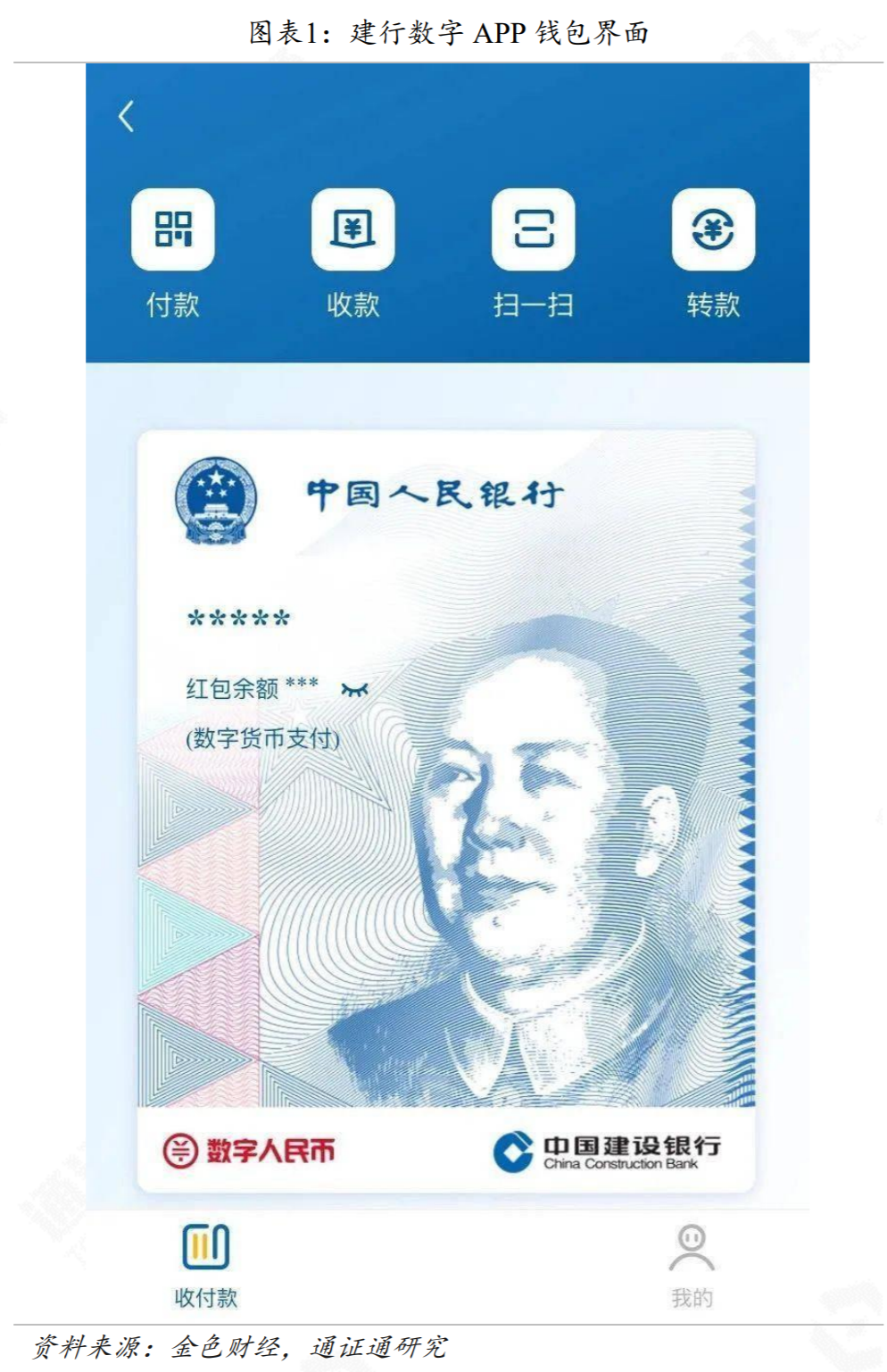

Around Saturday noon (local time), China Construction Bank (CCB), one of the “big four” state-owned commercial banks, reportedly launched a digital currency wallet feature in its official app.

Those who were able to register for the wallet and go through the user agreement posted numerous screenshots of different wallet pages.

The digital wallet renminbi provided a wide range of services, such as payment, redemption, transfer, and credit card recharge. Additionally, there were four levels of the wallet with different balance and withdrawal limits, which are presumably assigned to users based on their social credit score ranking.

According to a 21st Century Business Herald reporter, the top digital renminbi wallet level has an annual cumulative payment limit of 500,000 yuan, the second 300,000 yuan, the third 50,000 yuan, and the fourth 10,000 yuan.

However, CCB disabled the digital wallet feature from the public in a matter of just a few hours. The banking giant’s official statement says that the service has not been officially rolled out yet and will be made available to users in the weeks to come.

The short-lived access to the virtual wallet indicates that the bank has been working consistently towards implementing the digital yuan initiative headed by the nation’s central bank.

The remaining big four banks, namely Bank of China, Industrial and Commercial Bank of China, and Agricultural Bank of China, are likely to follow suit and roll out similar features in the near future.

As the largest market on earth is getting closer to what can be called “the most aggressive consolidations of economic power the world has seen” and a much more transparent financial system, the interest towards all things crypto is on the rise. If you promote cryptocurrency services and products, be sure to explore the opportunities ahead.

If you want to reach new GEOs and audiences, maybe it is all waiting for you on Telegram? We’ve prepared some material about Telegram audiences. What are the messenger’s users like this year? How old they are, what they do, and what they are interested in!